FBS in Malaysia

Home

Trading Options with FBS Malaysia

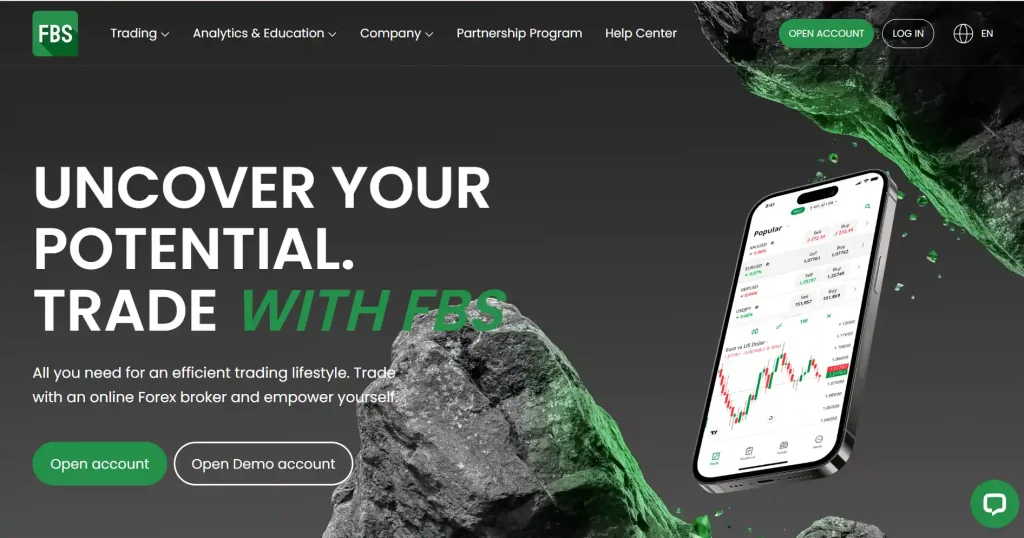

Malaysian traders can access multiple financial markets through FBS. The broker provides trading opportunities in forex pairs, commodities, indices, and stocks. Minimum deposits start from MYR 20, making it accessible for new traders. Trading is available through MetaTrader 4 and MetaTrader 5 platforms.

Key trading features:

- Over 70 currency pairs

- 400+ stocks for trading

- Leverage up to 1:3000

- Spreads from 0.7 pips

- Islamic account options

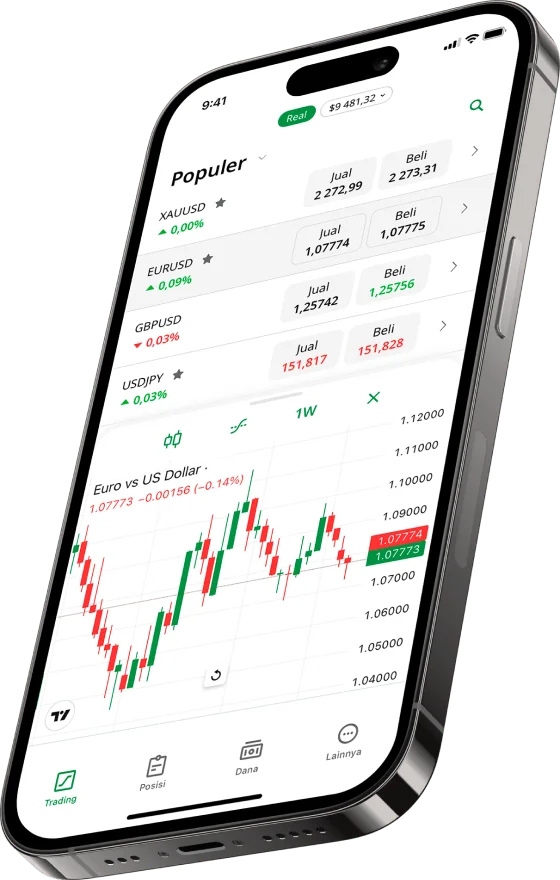

Mobile Trading Experience

The FBS mobile application caters to Malaysian traders seeking flexibility. Users can access their accounts, execute trades, and monitor positions through smartphones and tablets. The platform includes real-time quotes, technical analysis tools, and instant deposit features. Malaysian traders appreciate the localized interface and support for multiple languages.

Risk Management Tools

FBS provides Malaysian traders with essential risk management features. Stop-loss and take-profit orders help control potential losses and secure profits. Traders can set position limits and utilize margin calculators. The platform also offers negative balance protection, ensuring accounts cannot go below zero.

Account Types Available

FBS offers several account types for Malaysian traders:

Standard Account:

- Minimum deposit: MYR 20

- Floating spreads from 0.7 pips

- No commission

- Maximum leverage 1:3000

Islamic Account:

- Swap-free trading

- Available for Standard accounts

- Compliant with Shariah law

- Same trading conditions as regular accounts

Trading Hours and Support

Malaysian traders benefit from extended market access through FBS. The forex market operates 24/5, allowing flexible trading schedules. Support services align with Malaysian time zones, providing assistance during local business hours. Weekend support remains available for urgent matters.

Account Verification Process

Opening an account with FBS in Malaysia requires standard documentation. Traders must provide identification and proof of residence. The verification process typically completes within 24 hours. Malaysian residents can submit local documents, including MyKad and utility bills.

Payment Methods for Malaysian Traders

Local payment options include:

- Malaysian bank transfers

- Credit/debit cards

- E-wallets (Skrill, Neteller)

- Cryptocurrencies

Processing times and fees:

| Method | Processing Time | Fees |

| Bank Transfer | 1-3 days | Free |

| Cards | Instant | Free |

| E-wallets | Instant | 2-2.5% |

| Crypto | 15-20 mins | Network fee |

Seasonal Trading Events in Malaysia

| Malaysian Trading Events | Features | Duration | Requirements |

| Ramadan Trading | Extended support, Special spreads | 30 days | Active account |

| Year-End Promotion | Deposit bonus, Reduced fees | December | Min. MYR 100 |

| Chinese New Year | Trading competition, Prizes | 2 weeks | Trade volume targets |

| Merdeka Special | Patriotic trading contest | August | Malaysian traders only |

Trading Platforms and Tools

FBS provides multiple platforms:

MetaTrader 4:

- Advanced charting

- Expert Advisors support

- Mobile trading

- One-click trading

MetaTrader 5:

- More technical indicators

- Market depth

- Economic calendar

- Enhanced timeframes

FBS Trader App:

- User-friendly interface

- Direct market access

- Account management

- Technical analysis tools

Partnership Programs

FBS offers partnership opportunities for Malaysian market participants. Partners can earn commissions through client referrals. The program includes marketing materials and support in Malay language. Regular partnership events occur in Malaysian cities.

Trading Competitions

Malaysian traders can participate in FBS trading contests. These events offer prizes and recognition for successful trading strategies. Competition rules accommodate different trading styles. Results and rankings display on dedicated competition pages.

Educational Resources

FBS supports Malaysian traders with:

Trading Education:

- Webinars in local languages

- Trading tutorials

- Market analysis

- Economic calendar updates

Technical Support:

- 24/7 customer service

- Malay language support

- Live chat assistance

- Email support

Safety Measures

FBS implements robust security protocols for Malaysian clients. Data encryption protects personal and financial information. Two-factor authentication adds login security. Regular security audits ensure system integrity.

Community Support

Malaysian traders connect through FBS community features. Local trading groups share strategies and market insights. Regular webinars address Malaysian market perspectives. Social trading options allow strategy sharing among users.

Regulation and Security

Security measures include:

- Client fund segregation

- Negative balance protection

- SSL encryption

- Regular audits

Market Analysis Tools

Technical analysis tools help Malaysian traders make informed decisions. The platform provides multiple chart types and indicators. Economic calendars display events affecting Malaysian markets. Regular market updates include Asian trading sessions.

Market Analysis Services

FBS provides:

- Daily market updates

- Technical analysis

- Trading signals

- Economic news

Account Management Features

Traders access comprehensive account management through personal cabinets. Features include transaction history, trading statistics, and performance analysis. The system allows multiple account management from one interface. Malaysian traders can monitor all activities in real-time.

User Experience Analysis

| Aspect | Rating | Details |

| Platform Stability | 4/5 | Occasional connection issues |

| Customer Support | 4.5/5 | Fast response, multilingual |

| Withdrawal Speed | 3.5/5 | Some delays reported |

| Trading Conditions | 4/5 | Competitive spreads |

| Mobile Trading | 4/5 | App functionality concerns |

Frequently Asked Questions (FAQ)

The minimum deposit starts from MYR 20 for Standard accounts. Different account types may have varying minimum deposit requirements.

Yes, FBS provides swap-free Islamic accounts that comply with Shariah law. These accounts can be opened by selecting the Islamic account option during registration.

Withdrawal processing times vary by method: e-wallets (15-20 minutes), bank transfers (1-3 business days), and cards (2-7 business days). Some users report occasional delays during peak periods.